how affordability calculator

How Affordability Calculators Help You Manage Your Finances

Introduction

In today's world, managing finances wisely is more crucial than ever. Whether first time home buyer ma mortgage calculator planning to buy a home, a car, or even figuring out your monthly budget, affordability calculators can be your best friend. But what exactly are these tools, and how can they simplify your financial decisions? Let's dive in and explore how affordability calculators work and why they're essential for every savvy consumer.

Table of Contents

Sr#

Headings

1

Understanding Affordability Calculators

2

How Affordability Calculators Work

3

Benefits of Using Affordability Calculators

4

Types of Affordability Calculators

5

Using an Affordability Calculator for Mortgages

6

Step-by-Step Guide to Using an Affordability Calculator

7

Tips for Using Affordability Calculators Effectively

8

Common Mistakes to Avoid When Using Calculators

9

Importance of Accuracy in Affordability Calculators

10

Future Trends in Affordability Calculators

11

Conclusion

Understanding Affordability Calculators

Affordability calculators are online tools designed to help you determine how much you can afford to spend on a major purchase or as part of your regular expenses. They take into account your income, expenses, and other financial details to provide a clear picture of your financial capacity.

How Affordability Calculators Work

Affordability calculators use algorithms to analyze your financial information. They consider factors such as your income, debts, expenses, and desired loan terms to calculate how much you can comfortably afford to borrow or spend. Think of them as your virtual financial advisor, giving you personalized insights without the hefty consulting fees.

Benefits of Using Affordability Calculators

Using an affordability calculator offers several advantages. Firstly, it helps you avoid overextending your finances, preventing future financial strain. Secondly, it saves time by quickly providing estimates that would otherwise require manual calculations. Finally, it empowers informed decisions, ensuring you make choices aligned with your financial capabilities.

Types of Affordability Calculators

There are various types of affordability calculators tailored for different purposes, such as mortgages, auto loans, and personal finance management. Each type focuses on specific financial aspects relevant to the respective purchase or financial decision.

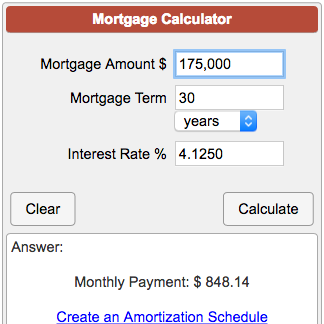

Using an Affordability Calculator for Mortgages

Mortgage affordability calculators are particularly popular. They consider factors like interest rates, down payments, and loan terms to determine the maximum mortgage amount you can afford based on your financial situation.

Step-by-Step Guide to Using an Affordability Calculator

- Gather your financial information: Income details, expenses, debts, and savings.

- Enter the required details into the affordability calculator fields.

- Review the results: Understand the calculated affordability range and what it means for your financial planning.

Tips for Using Affordability Calculators Effectively

- Be honest about your financial details.

- Use multiple calculators for comparison.

- Consider future expenses and financial goals.

Common Mistakes to Avoid When Using Calculators

- Neglecting to include all expenses.

- Relying solely on maximum borrowing limits.

- Ignoring interest rate fluctuations.

Importance of Accuracy in Affordability Calculators

Accurate calculations are crucial for making sound financial decisions. Even minor errors in input can significantly affect the results, potentially leading to unrealistic financial commitments.

Future Trends in Affordability Calculators

Advancements in AI and machine learning are likely to enhance affordability calculators. Expect more personalized insights and real-time adjustments based on economic conditions and user data.

Conclusion

In conclusion, affordability calculators are invaluable tools for anyone looking to make informed financial decisions. By understanding your financial limits and capabilities, you can navigate major purchases and financial commitments with confidence.

FAQs (Frequently Asked Questions)

1. What is https://calculatoronline.icu/cumulative-interest-calculator-excel/ , and why should I use one?